Fulfill Your Banking Needs Anytime Anywhere

Technology advances with time and so must financial management tools. Hang Seng Personal e-Banking Services, specially designed for local customers, provide 24-hour personal banking services, 7 days a week. With just a computer, you can now manage your banking accounts safely and conveniently anytime, anywhere.

Get the Most out of Online Banking

Our Personal e-Banking Services aim at providing you with an affable banking experience. The moment you log on to our website, you will be greeted with a personalised welcome message. What's more, you can also enjoy many more convenient services with just a click:

Accounts Enquiry:

Check the balance and transaction history of all your accounts with any branch/sub-branch of Hang Seng Bank (China) Limited, including savings, time deposit and loan accounts, so you can keep up-to-date with your latest financial status.

Transfers and Remittance:

Transfer between your accounts within Hang Seng Bank (China) in the same currency with the following options :

- Immediate transfer

- Forward dated transfer setting up to a maximum of 60 days in advance

- Recurring transfer at various frequencies - daily, weekly, monthly, quarterly, etc.

What's more, you can also:

- Transfer fund to pre-registered third party accounts within Hang Seng Bank (China)

- Transfer fund to pre-registered accounts maintained with other banks in Mainland China

- Remit fund to pre-registered overseas bank accounts

- Remit remaining balance from RMB TT Account back to your pre-registered HK Hang Seng RMB Account (Only available to Hong Kong or Macau residents who have valid HK Hang Seng RMB Account)

- Our personal customers will enjoy following benefits through remittance via e-Banking.

1. Personal customers remit RMB to other local banks will be eligible for fee waivers.(From 1st January to 31st December 2024)

Foreign Currency Sale And Purchase:

Conduct foreign exchange settlement and purchases within annual quota for local residents and conduct foreign exchange settlement within annual quota for overseas residents.

Foreign Currency Exchange:

Conduct the conversion between different foreign currency saving accounts.

Open Foreign Currency Account:

Open foreign currency saving accounts in different currencies

Time Deposits:

Place new Time Deposit and set up/change Maturity Instruction.

Rates Enquiry:

Enquire deposit interest rates and major foreign exchange rates against Renminbi.

e-Statement/ e-Advice:

e-Statement provides you with an instant access to your bank statements online or you may download them to your computer for record in a more convenient way. e-Advice allows you to receive your bank advices through messages that are sent to the "Read Messages / e-Advice".

Customer Services:

You can also enjoy other services:

Through our Customer Services Section such as stop cheque, e-Banking password change, interim statement request, your personal information update, account(s) under Personal e-Banking maintenance and banking services enquiries via e-mail.

24-Hour Customer Service Support:

To provide comprehensive customer support, we offer a 24-hour customer service hotline to answer customer enquiries on e-Banking services. You can contact our Customer Services Representatives anytime on our Customer Service Hotline for any technical assistance while using e-Banking services.

Hang Seng China Mobile Banking

One click to experience quick and safe mobile banking APP from Hang Seng China.Hang Seng China mobile enables personal banking customers to:

- View details, balance and transaction histories for bank accounts

- RMB domestic remittance and Foreign currency remittances

- Wealth Management

- Foreign exchange services

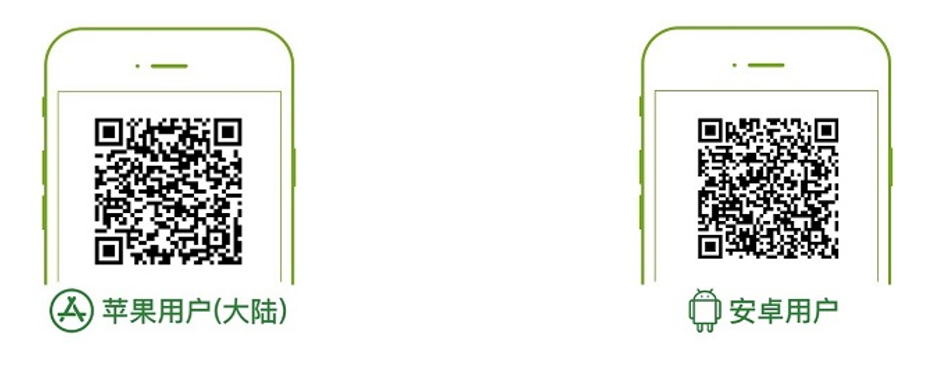

How to download Mobile Banking APP?

Our Mobile Banking APP can support both iOS and Android Systems.

Customers whose Apple ID or Android account is registered in mainland China.

iPhone: Please search “恒生中国” and install from Apple App Store.

Android: Please visit HUAWEI AppGallery, Xiaomi GetApps and 百度手机助手 search “恒生中国” and install after downloading the APP.

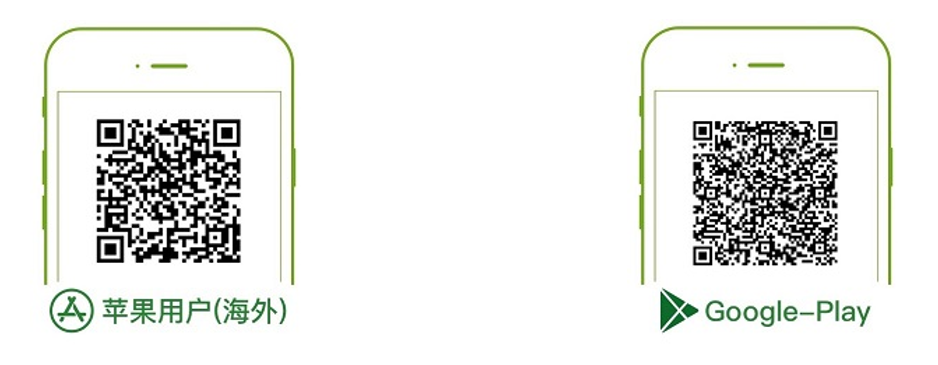

Customers whose Apple ID or Google Account is registered in Hong Kong, Macau, Taiwan and overseas.

iPhone: Please search “恒生银行中国” and install from Apple App Store.

Android: Please visit Google Play, search “恒生银行中国” and install after downloading the APP.

If you are an Android user and it is not convenient for you to download or update the mobile banking APP from HUAWEI AppGallery, Xiaomi GetApps and 百度手机助手, you can scan the following QR code through your mobile browser orclick hereto download and use it directly.

Please always upgrade the APP to the latest version to enjoy full Mobile Banking functions and services.

How to Apply and Register

Simply download the Personal e-Banking Services application form or visit any branch/sub-branch of Hang Seng Bank (China) Limited, to complete and submit the application form to apply for Hang Seng Personal e-Banking.

You will be issued an Electronic Banking Number (EBN), a PIN and a Security Device and then you can register our Personal e-Banking to start experiencing the convenient online service. You can also register our Personal e-Banking with your Hang Seng Debit Card Number, ATM PIN, Issue Number and the Security Device.

For more information, please contact any branch/sub-branch of Hang Seng Bank (China) Limited.

you are currently logged off to e-Banking.

you are currently logged off to e-Banking.